When you’re shopping around for a used car, and particularly so if that specific car might be prone to some issues every now and then, getting an aftermarket warranty is one of the best things you can do. You could think of it as a way to hedge your bets on how much money you could save, one way or the other…

For the most part, it’s either one of two scenarios;

- 1) You could choose to not get that aftermarket warranty and not pay for anything extra besides purchasing the car, and who knows, you might be very lucky, and there could be that sliver of a chance that nothing on your car ever goes wrong, and you end up spending £0.

- 2) However, for some cars, the chances for failure are far too great, and when things do fail, they could cost you thousands of pounds to get those repairs sorted out. So, having an aftermarket warranty is a good way to limit your downside to however much you’re paying in monthly or yearly premiums, while that warranty covers those repair costs for you.

With those odds in mind, and given that I’ve recently added to the Motor Verso project cars fleet a peachy 2016 Bentley Continental GT, getting an aftermarket warranty is a must. Thankfully, getting an aftermarket warranty and applying for one is supremely easy, just like how I managed to get one pretty comprehensive warranty plan and coverage from Warrantywise.

Warrantywise is one of the leading aftermarket automotive warranty providers here in the UK, and in this guide, I’ll go through the simple step-by-step process on how you could apply for an aftermarket warranty for your used car. It’s so easy, in fact, that you can get started in just three simple steps:

- Step 1: Head over to Warrantywise’s main site and click on “Start A Quote”.

- Step 2: Inputting all of your car’s specific details and providing your personal contact info.

- Step 3: Wait for Warrantywise to send over a personalised quote for your car and review it.

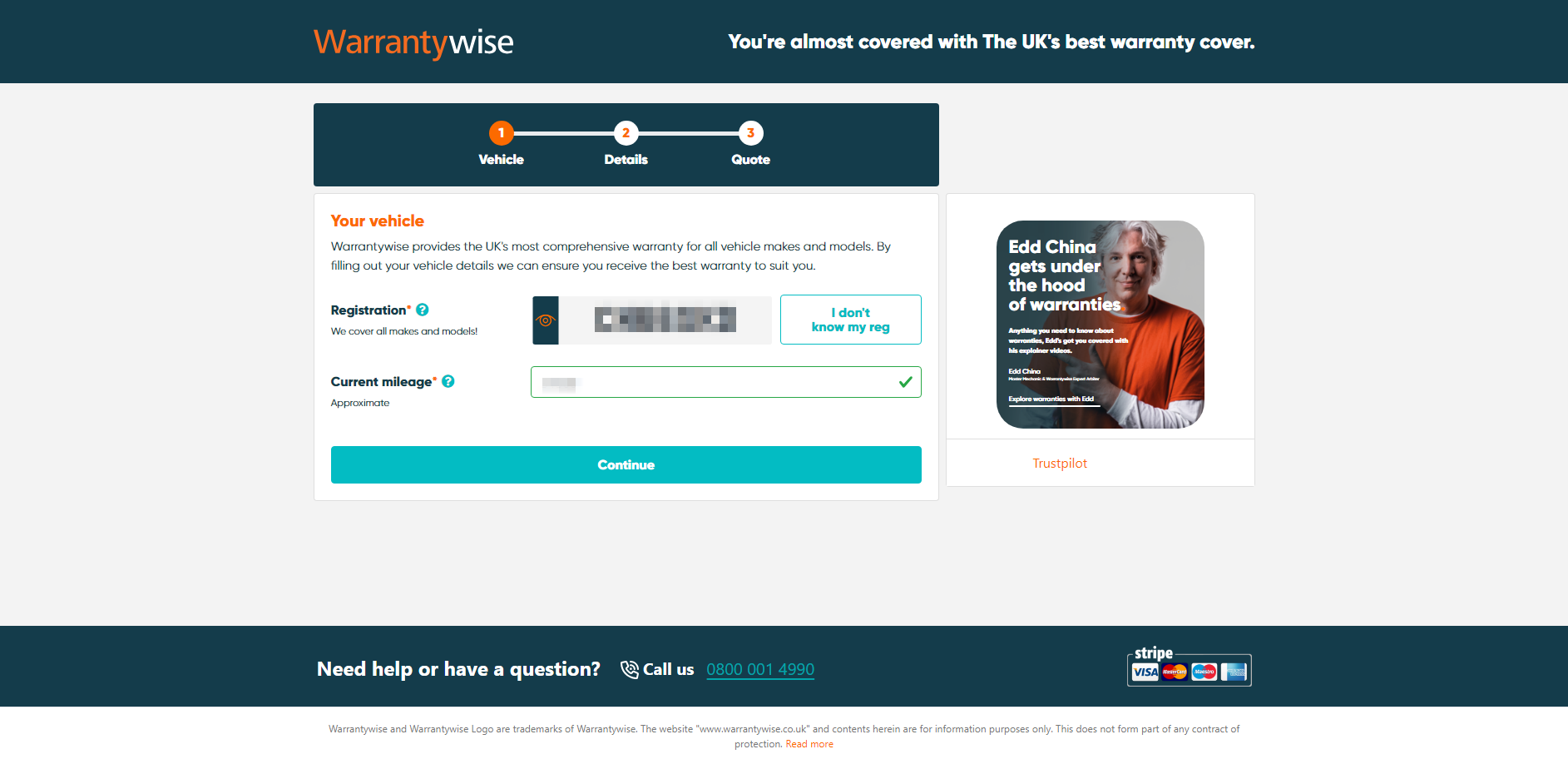

Step 1: Heading Over To Warrantywise’s Website

Okay, this is pretty straightforward, but like most aftermarket warranty providers, Warrantywise lets you apply and ask for a warranty quote for your car straight from their website. So, first up, head over to their main website here.

Once you’re there, click on that huge teal-blue “Start A Quote” tab on the right-hand side of the top-most navigation bar. This should now open up a new page where you can input the details of the particular car that you’re trying to get an aftermarket warranty coverage for. This now leads us to Step 2, below.

NOTE: Most other aftermarket automotive warranty providers will have a similar starting process, either with a button or tab that says “Get A Quote“, or something similar to that.

For added context, and to make sense of the later steps down below, Warrantywise, in particular, has five different warranty plans and levels of coverage that could be suited for your car, all limited by its age and mileage:

- 04/40 Plan (Platinum Plus) – Vehicles up to 4 years old and have under 40,000 miles

- 06/60 Plan (Platinum) – Vehicles up to 6 years old and have under 60,000 miles

- 08/80 Plan (Gold) – Vehicles up to 8 years old and have under 80,000 miles

- 10/100 Plan (Silver) – Vehicles up to 10 years old and have under 100,000 miles

- 12/120 Plan (Bronze) – Vehicles up to 15 years old and have under 150,000 miles

Step 2: Input All Your Car’s Specific Details & Information

With that new page opened, you’ll then be prompted to type in your car’s registration plate numbers, as well as the current mileage. You’ll also notice that this too is a 3-step process, as additional pages would then load thereafter to prompt you to input additional information and details about your car.

For now, on Page 1, that ‘Current Mileage’ box doesn’t need to be an exact mileage figure, if you’re unable to get it, but as long as you can approximate it as closely as possible, that’s fine. This is crucial, as the folks at Warrantywise – as with other warranty providers – need to run a quick history check on your car.

This determines two key factors – 1) how old your car is, and 2) how much mileage it’s accrued. This allows Warrantywise to then offer you a suitable warranty coverage and protection plan that’s best tailored for a specific car. Moreover, it informs Warrantywise of what risks your car may represent in terms of potential faults, problems, or breakdowns down the line.

A general rule of thumb… “The older your car is, and the higher the mileage figure; the higher the risk of something going wrong (thus, the more you’ll have to pay for a suitable warranty plan)“.

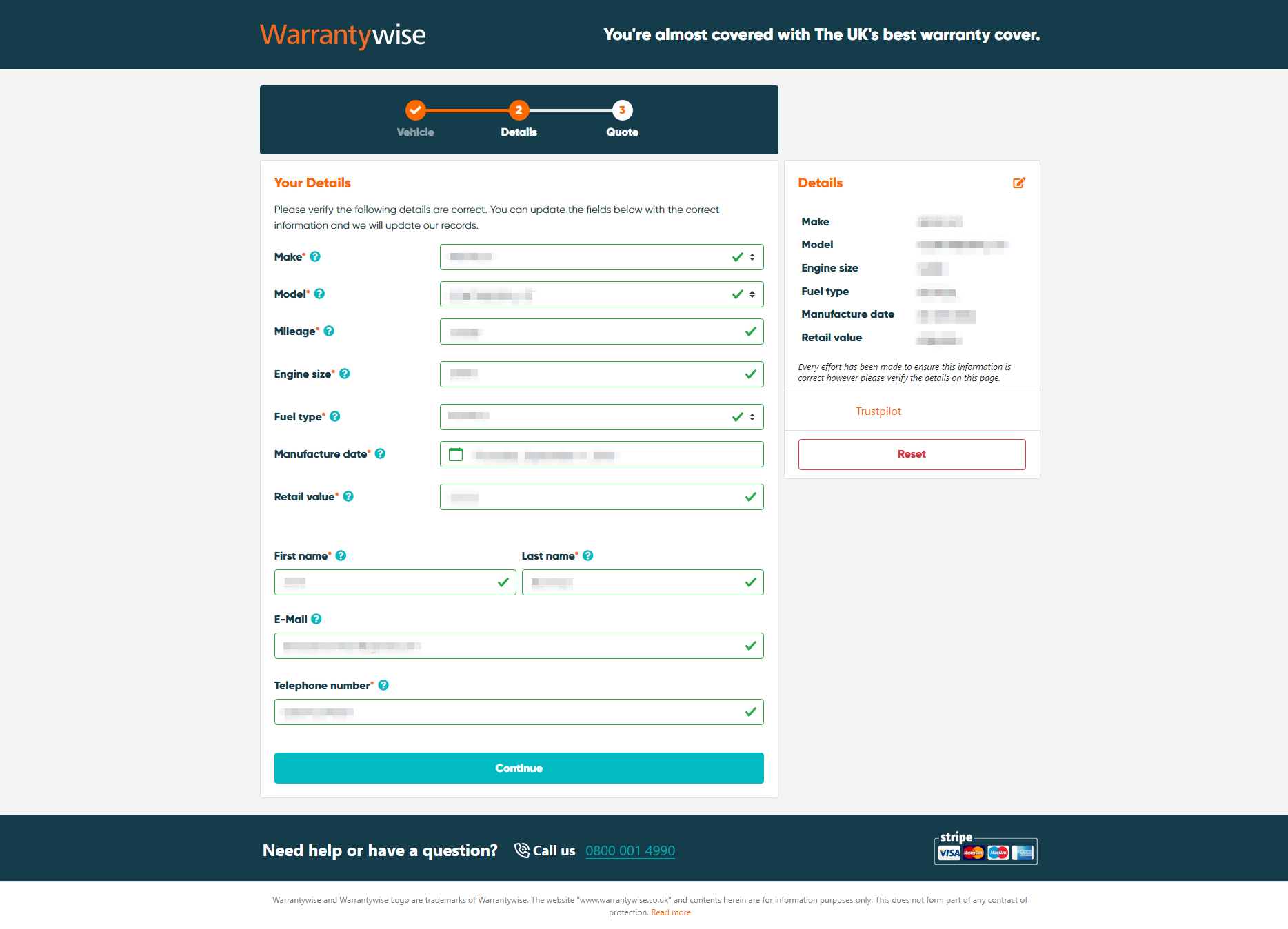

Moving on, once you’ve typed in your car’s registration plate number and current mileage, the next page will load up, and you’ll now be prompted to input additional, more granular or specific details about your car. This includes details such as:

- Make and model

- Mileage (to confirm the previous figure)

- Engine size

- Fuel type

- Manufacture date

- Estimated retail value

Finally, you’ll then be asked to input your personal contact information. This is so that Warrantywise could send over the final warranty quote to you, detailing what sort of coverage they’re able to offer. This would come in the form of a single-page PDF file, detailing everything you need to know before moving on.

Step 3: Receiving A Quote From Warrantywise

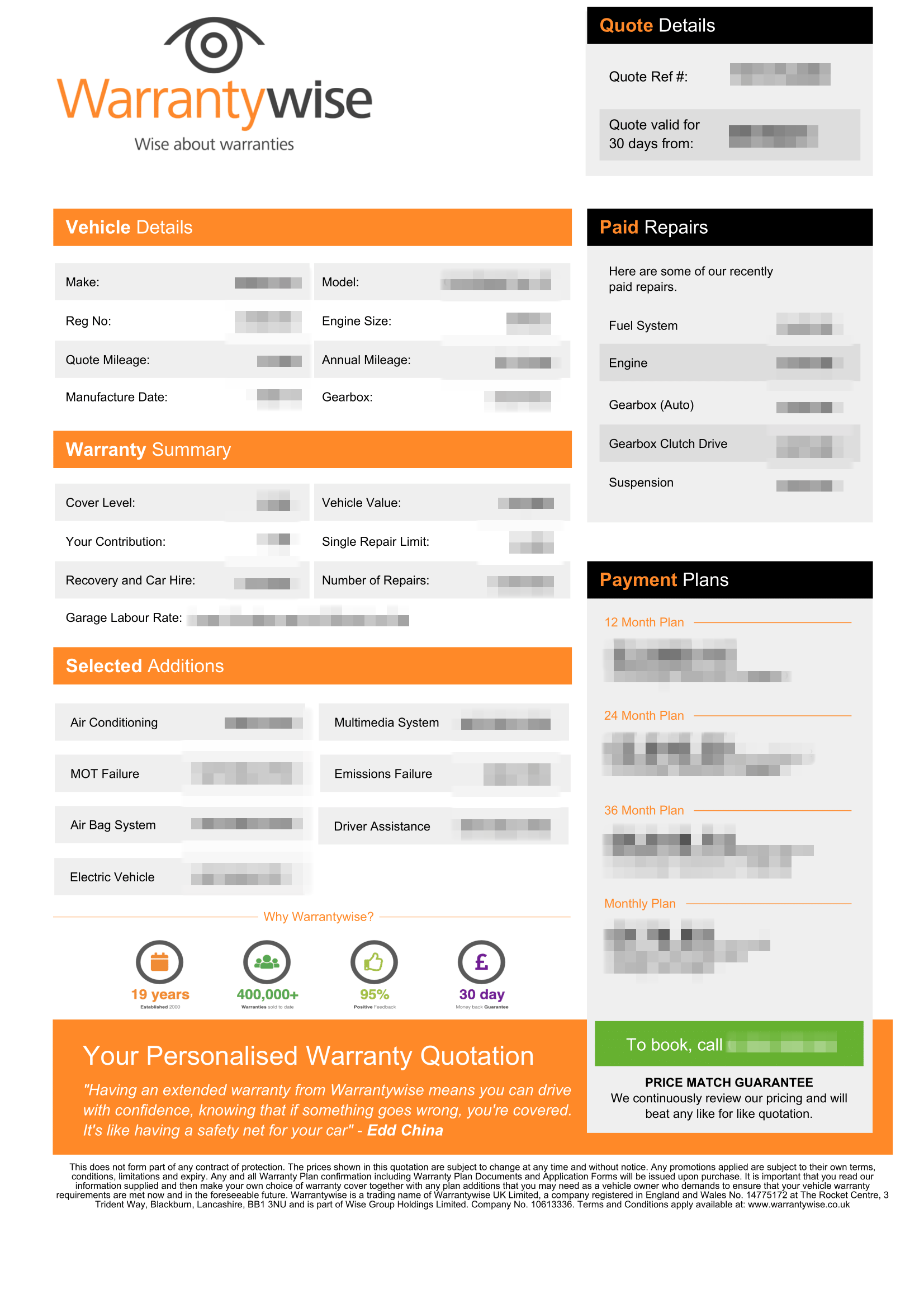

Upon sending over all of your car’s details to Warrantywise and submitting your application on their site, it will take a bit of time for them to send over the final quote. Once you receive it, that quote would generally summarise your car’s key details which you’ve typed in earlier, as well as a summary of what warranty plan Warrantywise is able to offer for your car.

Therefore, within this PDF, you’ll have the chance to review various aspects of the coverage offered. Note, this is only a quote and estimation for now, and would not necessarily reflect the final coverage that you’ll get – refer to Warrantywise’s 5 levels of coverage that I mentioned earlier. For now, though, this PDF quote will tell you things such as:

- The number of individual repairs that can be covered by the specific warranty plan offered by Warrantywise

- Limits for how much the warranty plan in question could cover for a single repair (i.e. a maximum of £5,000)

- Whether you’re going to receive a complimentary recovery service for your car or a car hire

- How much of the workshop labour hours are being paid by the warranty plan (i.e. a maximum of £150 per hour for labour)

- How much is your contribution amount (this contribution amount goes toward paying some of the repairs out of pocket, so the higher the contribution, the lower the monthly premiums will be, but there’s also the option to not have a contribution)

- What specific parts of your car are covered, as decided by you earlier, as you were applying for a quote (i.e. whether or not air conditioning problems are to be covered by Warrantywise)

This warranty quote is valid for a total of 30 days, so in the meantime, you’ll have enough time to consider this in the context of your personal finances. You could then decide whether it’s worth it or not, or you can even use this 30-day period to compare their quotes against other aftermarket warranties, and whether they could provide you with a better deal.

Crucially, this quote from Warrantywise also states how much it’ll cost you, and the payment plans that it sets out which you can consider. You could either pay as part of a 12-month, 24-month, or 36-month plan (1, 2, or 3 years, with options for monthly instalments), and there’s also a monthly payment plan, too.

You can now review this quote, and decide whether it’s worth moving forward. Warrantywise offers you a few options later on, like choosing to upgrade or change to a different plan, though they may also prompt you for additional information about your car, such as taking a photo of your car’s odometer to confirm its mileage.